Tax In Saudi Arabia Increase

/media/img/mt/2020/06/SaudiArabianTaxIncrease/original.png)

The tax on most goods and services was first introduced in saudi arabia in 2018 as a way to increase revenue.

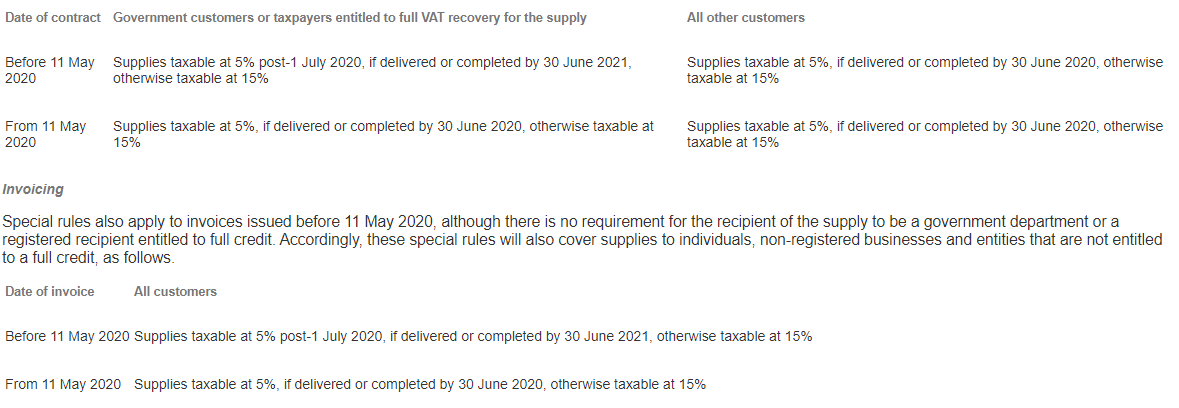

Tax in saudi arabia increase. Vat rate to increase to 15 covid 19 the ministry of finance on 10 may 2020 announced an increase to the value added tax vat rate measures to counter the economic implications of the coronavirus covid 19 pandemic. Vat rate to increase to 15 covid 19 saudi arabia. Neighboring states such as the united arab emirates have so far. Saudi arabia said it would also increase value added tax from 5 to 15 as of july.

The government of the kingdom of saudi arabia ksa has announced that the value added tax vat rate will increase to 15 from the current 5 effective 1 july 2020. Dubai united arab emirates ap saudi arabia announced monday it was tripling taxes on basic goods raising them to 15 and cutting spending on major projects by around 26 billion as it. Steel iron nickel copper aluminium cement ceramic machinery equipment and electrical equipment toys furniture vehicles and various other. If the changes in the 27 billion austerity package are permanent once tax free saudi arabia will soon become a very different place.

The government of the kingdom of saudi arabia ksa has announced an increase in the customs duty rates for an extensive range of goods including foodstuff mineral and chemical products plastic rubber leather goods textile and footwear base metals e g. Steel iron nickel copper aluminium cement ceramic machinery equipment and electrical equipment toys furniture vehicles and various other manufactured goods. Facing worsening budget deficits the saudi government has decided to reduce spending and triple the tax it first imposed in 2018.